股价

Clariant targets to create value for shareholders by achieving above-average returns. This includes an attractive capital allocation policy to deliver shareholder value by aiming to continuously distribute a substantial part of underlying net income to our shareholders.

Please use the Shareholder Center to find any relevant information about the Clariant share, the Annual General Meeting and more.

Share Price and Share Information

Share details

Valor symbol CLN Nominal value CHF 1.34 Valor number 1214263 Security Type Registered share ISIN CH0012142631 Number of outstanding shares 331 939 199 Trading Currency CHF Free float 63.34 % Stock Exchange SIX Swiss Exchange Bloomberg CLN SW Country

Switzerland

Reuters CLN.VX Index Member

- MSCI Equity Switzerland Index

- SMI Mid

- SMI Expanded

- SPI

- SPI Extra

- SPI ex SLI

- SPI ESG Weighted

- SPI ESG

- Swiss All Share Index

- UBS 100 Index

- SPI Select Dividend 20

Data per share

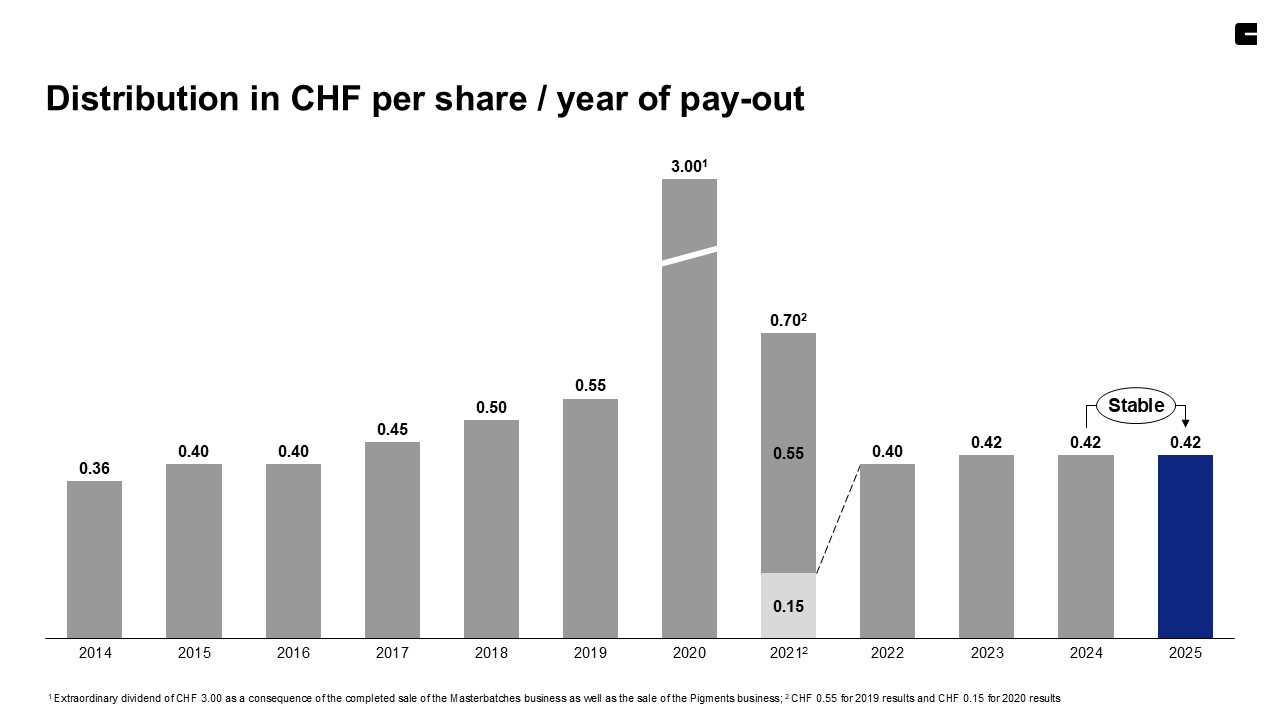

Five-year overview and dividend 2025 2024 2023 2022 2021 Number of registered shares issued 331 939 199 331 939 199 331 939 199 331 939 199 331 939 199 Number of shares eligible for dividend 328 875 656 328 285 611 328 848 494 329 016 801 329 116 487 Price at the end of the year (CHF) 7.16 10.09 12.42 14.65 19.00 High of the year (CHF) 11.18 15.15 16.18 20.40 20.50 Low of the year (CHF) 6.57 9.66 12.30 13.90 17.07 Market capitalization at year end (CHF m) 2 377 3 349 4 123 4 863 6 307 Basic earnings per share (CHF) - 0.23 0.74 0.51 0.26 1.04 Distribution per share (CHF) 0.421, * 0.421 0.421 0.421 0.401

1 = Through capital reduction by way of par value reduction

* = Subject to the approval of the AGM

Distribution

Clariant commits to its continuous capital Distribution policy and continued success sharing with our shareholders based on improved financial performance.

Distribution 2025

The Annual General Meeting of Clariant Ltd, as held on 1 April 2025, approved the proposal of the Board of Directors for a regular distribution of CHF 0.42 per share based on Clariant’s performance in 2024. This distribution was made through a capital reduction by way of a par value reduction.

The payment to shareholders in the amount of CHF 0.42 per registered share was made beginning of June 2025, after a successful registration of the ordinary capital reduction in the Commercial Register. Please first contact your bank or broker in case you have questions about the distribution related to your Clariant holdings.

Contact us

Clariant’s Investor Relations team is committed to an open and fair dialogue with all of its stakeholders. Please contact us.