How recyclable carpets could transform the flooring industry

On the go? Click here to listen to this post in our podcast!

Delivering on Clariant's purpose »Greater chemistry - between people and planet.«

This story is an example of how Clariant delivers on its purpose-led strategy.

Carpet's reality: 1.6 million tonnes of waste a year

Most carpets still end up in landfill or incineration, locked out of the circular economy. In Europe, an estimated 1.6 million tonnes of carpet waste reach the end of their lives every year. According to data from Deutsche Umwelthilfe from 2017, the vast majority of it, nearly 98%, is either incinerated or sent to landfill. While the use of polyester has improved recycling rates, this improvement remains in the low single-digit percentage range. Germany alone contributes around 400,000 tonnes to this waste stream annually.

In the United States, 4 billion pounds (approximately 1.8 million tons) of carpet waste are generated annually. Of this enormous amount, only 5% is recycled and 6% is incinerated for energy recovery. The remaining 89% ends up in landfills. These figures highlight a significant environmental problem, as most carpet materials are not biodegradable and therefore remain in landfills long-term. The low recycling rate indicates considerable potential for improved circular economy practices in the carpet industry. 1)

Despite the fact that most carpet face fibers are technically recyclable, the way carpets are constructed has historically locked them out of the circular economy.

For decades, latex-based backings have been the standard in carpet production. While effective at binding fibers, latex creates a complex, inseparable composite. Once combined with pile fibers, the materials are bound together permanently. The result: carpets that perform well during use, but are destined to become waste at the end of their life. This model is increasingly untenable. Policymakers are raising the stakes with Europe's Extended Producer Responsibility (EPR) schemes for textiles, mandating separate collection of textile waste by 2025. At the same time, consumers and property developers are scrutinizing not just the look and feel of flooring, but its carbon footprint and recyclability. The flooring market, valued in the hundreds of billions globally, is at an inflection point.

Hard surface growth vs. carpet's staying power

Luxury Vinyl Tile (LVT) dominates design trends, but carpets remain essential in homes, offices, and commercial spaces. Over the past two decades, carpets have steadily lost market share to hard surface alternatives, most notably Luxury Vinyl Tile (LVT). LVT has captivated designers and contractors with its durability, ease of installation, and uncanny resemblance to wood and stone. Globally, it accounts for a significant share of new flooring installations.

Yet carpets are far from obsolete. In residential markets, particularly in bedrooms and living areas, consumers continue to prefer carpets for their warmth, comfort, and acoustic properties. In commercial spaces, carpet tiles have become the dominant modular flooring option, accounting for around 44% of modular revenues. Carpet's resilience lies in its versatility and its ability to adapt to design trends. What has held the category back is its environmental baggage, and this is where innovation is beginning to change the story.

Hot-melt coating: 80% less energy, zero wastewater

Compared to traditional latex coating, hot-melt technology offers significant environmental benefits. The manufacturing process with hot-melt coatings consumes up to 80% less energy 2) and generates no wastewater, as it doesn't require the drying and vulcanization processes necessary with latex. This efficiency gain results from the fundamentally different coating process itself. Hot-melt coatings are applied in a molten state and harden through cooling, while latex systems require energy-intensive drying and curing processes with high water consumption. This shift to hot-melt technology represents a significant step toward reducing the ecological footprint in carpet production, regardless of the material composition of the end product.

Real-world proof: tiles, turf, and aviation

The potential for recyclable carpets is not confined to residential or office interiors. Mono-material design specifically for PP and PET carpets allows for their downcycling into less performance-demanding items like flowerpots or waste bins, marking a first step toward circularity. This becomes more challenging when using different raw materials in carpet construction. A particular advantage of PET-based carpets lies in the possibility to depolymerize and subsequently repolymerize the material through chemical processes, achieving a closed material loop with virgin-quality material.

Carpet tiles, the workhorse of the commercial sector, are now being designed for cradle-to-cradle loops. For carpets with multiple components, such as those using Polyamide 6 yarn or natural fibers like wool, the recycling process developed by the Fraunhofer IVV and patented by Clariant for floor coverings guarantees pure recovery of the raw materials used, regardless of their composition, solving a critical barrier to true circularity.

Collection and sorting at the end of the lifecycle represents one of the biggest challenges in achieving a truly circular economy for carpets. Despite technological advances in recycling processes, establishing efficient collection systems and accurate sorting methods remains a significant hurdle.

In sports infrastructure, artificial turf is another major application. Modern turf systems typically combine polyethylene fibers with a primary backing based on either PP or PET. While latex and polyurethane are traditionally used as backing materials, polyolefin (PO) backing offers an alternative for better recyclability. Polypropylene-based solutions not only provide the necessary stability and tear resistance but are also fully recyclable, aligning with sustainability targets set by sporting bodies such as FIFA. Even specialized markets such as aviation, where carpets must pass stringent flame, smoke, and toxicity standards, are seeing recyclable alternatives that meet performance requirements. Recyclable carpets are already delivering performance across diverse applications.

Market shift: policy, pressure, and opportunity

The implications extend beyond sustainability. As EPR legislation takes hold, manufacturers that cannot demonstrate recyclability may face penalties or higher producer fees. By contrast, those offering mono-material, recyclable flooring could enjoy cost advantages and stronger positioning in bids where circularity is part of the specification. There are also brand implications. Interface, Tarkett, and other global players have already invested heavily in take-back programs, reclaiming millions of pounds of carpet tiles in markets like North America. California, with its carpet stewardship program, reported a record 38.5% recycling rate in 2024, demonstrating what is possible when infrastructure and incentives align. These examples signal to the broader industry that circular flooring is not just aspirational — it's happening.

Materials that enable circular flooring

Carpet may never reclaim the dominance it once had, but it doesn't have to. By aligning with circular economy principles, the industry can carve out a future where carpet is not just a flooring option of comfort and style, but also one of responsibility and resource efficiency.

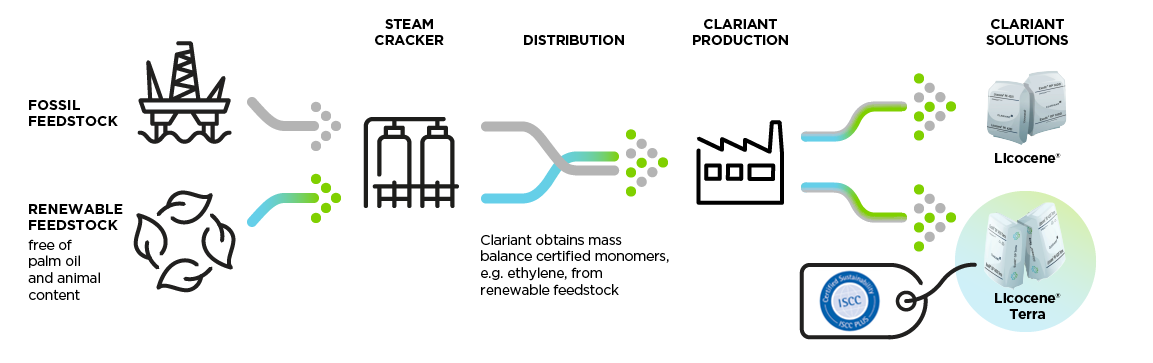

New materials are leading the way. Licocene™ polymers, for example, are already enabling recyclable carpet systems by turning backings into polyolefin-based layers that can be reprocessed. And with the Licocene™ Terra line, which uses mass-balance certified renewable feedstocks, the industry now has an option that is both recyclable and renewable.

Carpets redefined: from waste to resource

The image of carpets as bulky, unrecyclable waste could soon give way to something entirely different: a flooring solution designed to be used, recovered, and used again.

Advancing sustainability with Licocene™ Terra

The carpet industry is quickly moving toward circularity, and Clariant’s Licocene™ polymers have played a crucial role in making recyclable carpet systems possible. Now, Licocene™ Terra builds on this innovation, combining reliable performance with renewable feedstocks to reduce its environmental footprint.

Renewable feedstock, same reliable performance

While standard Licocene™ products are based on fossil materials, Licocene™ Terra is produced using mass-balance certified renewable feedstocks. The result? The same bonding strength and process efficiency with a reduced carbon footprint.

Here’s what sets Licocene™ Terra apart:

- Renewable-based, made with certified renewable feedstocks instead of fossil resources.

- Lower CO₂ footprint: proven to reduce emissions compared to conventional Licocene™ grades.

- Drop-in solution: performs just like the fossil-based versions; no process changes are needed.

- Responsible choice: free from palm oil derivatives and animal ingredients.

Selected Licocene™ Terra products are OEKO-TEX® ECO PASSPORT certified, meeting strict safety and sustainability requirements, which is a key factor for manufacturers responding to growing customer and regulatory demands.

Licocene™ Terra is the next step toward a renewable, circular adhesive future. It proves that sustainability and performance can coexist, helping the carpet industry move closer to a fully circular model.

1) source: SleepBloom.com - Carpet Waste in the USA

2) source: Lacom – Laminating and Coating Maschines; Aumann AG